Hybrid Retail

By Jane Genova

Since COVID, documents management consultant McKinsey & Company observes that three-fourths of shoppers have changed how they make purchases. However, that was not to abandon brick-and-mortar for ecommerce. According to the U.S. Bureau of Census, 75 percent of purchases are made in brick-and-mortar. As IBM points out, being in a real store helps shoppers feel “normal,” an intangible human beings treasure in these uncertain times.

But something is changing in brick-and-mortar. That is this: Buyers expect online and offline to be seamless. They demand to experience online and brick-and-mortar as a continuum. Sooner than later, that continuum could include the metaverse, which is virtual reality.

That blurring of boundaries is being called the “hybridization of retail.” To accommodate those emerging expectations, brick-and-mortar retailers will have to reimagine just about every aspect of their businesses. In the process, they could boost profit margins.

Hybridization of retail

What is hybrid retail? No, it does not necessarily mean that brick-and-mortar retailers have to add an online store. Actually, marketing expert WebFX recommends against that as too difficult, expensive and likely to fail. According to Failory, about 90 percent of ecommerce ventures go kaput. The obstacles range from the details of maintenance to the expense of inventory storage and fulfillment.

Actually, the term “hybrid retail” is an abstract one. At its core it is a concept retailers have to understand in order to continue to survive and thrive. Marketing agency Meticulosity describes hybrid retailing basically as opening to new possibilities in how brick-and-mortar can sell. Those are needed because, as Forbes confirms, about 70 percent of the customers coming into the store are digitally influenced. That digital influence is the driver in hybrid retailing.

Digitally influenced

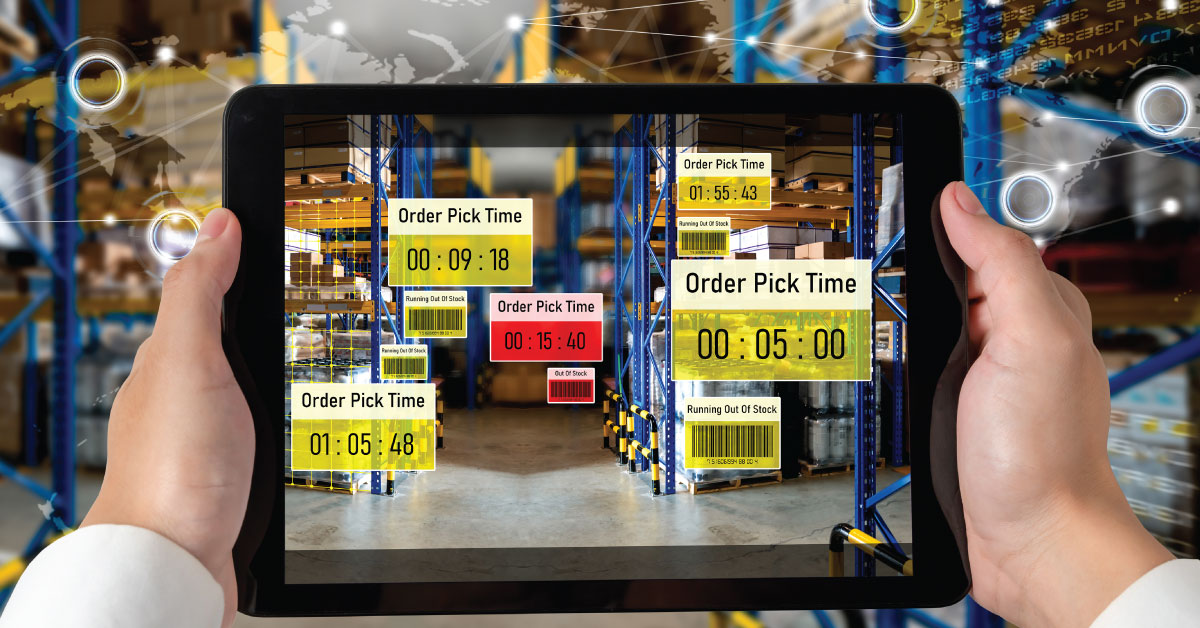

The digitally influenced customers know what is online. What they know ranges from product types and pricing to environmental impacts and controversies. They expect brick-and-mortar to also know all that – and to then respond in a smart, businesslike way. That is the core of hybrid retailing. In a sense, online has a permanent “presence” in brick-and-mortar. But its operations do not have to be embedded in the brick-and-mortar structure, per se.

No longer Pop’s store

In those classic late 1930s and early 1940s movies, the “kids” played by Mickey Rooney and Judy Garland would put on a show to save Pop’s store. Back then the store was a simple operation. And mostly that has held on. It limits itself to nuts-and-bolts functions. Those were and still are usually restricted to determining what inventory to order, displaying it, assisting with customers’ questions and ringing up the transaction. Retailers often select a model they perceive as successful for how to structure their stores.

In hybrid retail, that kind of insulated formulaic system will not accommodate the digitally influenced. The technology of ecommerce is forcing Pop’s store to take that gigantic conceptual leap into reimagining what a retail experience can be.

The challenge is for brick-and-mortar to navigate hybrid retail without getting caught up in brutal competition with the terms and conditions of online shopping. What could go very wrong, of course, is for retailers operating physical stores to be victims of a price war.

The real business of brick-and-mortar

Fortunately, retail is not the first industry that has been tossed into upheaval by technology. There are myriad lessons already in place for it to learn from. The classic one – a kind of negative learning – had been the railroad industry. It essentially collapsed. The late Harvard Business School marketing professor Ted Levitt explained how that could have been prevented.

The business principle Levitt articulated was the need for industries in transition to ask themselves: What business are we really in? The right answer for the railroad was the broad field of transportation, not the narrow one of operating a railroad. By reframing, railroads could have acquired emerging forms of transportation such as airlines and continued to grow.

Posing similar questions can free brick-and-mortar to see itself as well as the technology impinging on it through a whole different kind of lens. As Meticulosity noted, that vantage point is one of possibility. That has no limits. And it could prevent price wars with online shopping and having to cave to unprofitable terms and conditions.

The customer

Searching for the answer to What Business Are We Really In starts with what kind of store customers want to shop in. Loyalty is dying, documents McKinsey. COVID accelerated that trend, in which at least one-third are switching retailers.

How do you find out what customers want and need? Inc., the publication devoted to smaller businesses, makes these recommendations:

Meet with them. That represents a form of the all-important principle of personalization or directly connecting with human touch points.

Participate in trade shows. There, instead of focusing on the outcome of selling, concentrate on picking up clues about the market.

Watch. Rarely are customers able to articulate what they want. More often that is disclosed in how they behave. The more insight there is in general behavior, the more dots that can be connected about an emerging market. The clumsy behavior of professionals struggling to transmit large documents indicated to those observing this the need for a fax machine.

Use the Net Promotion Survey (NPS). That produces concrete data. The utility is in how the information is interpreted.

Fluid fit

There are no right answers about what business the brick-and-mortar could really be in. But the better ones make for a brilliant fit with the fluidity of hybrid retail. For example, a retailer can transform itself from a shop that sells outdoor equipment and apparel into one whose mission is assisting customers on every aspect of their purchasing journey. For that, the retailer could research new supply chains to ensure the kind of fast availability that is the signature of ecommerce. In addition, through different supply chains, unique products can be ordered for customer wish-lists. Such personalization creates value that online usually cannot. That strategy is the “hybrid supply chain.”

There is also “hybrid distribution.” Customers want a hunting jacket that the brick-and-mortar retailer knows is only available through an online competitor. So, brick-and-mortar refers them online. It was through recommending competitors’ products as a new adopter of the blogging medium in 2003 that troubled Microsoft began restoring its brand.

In this shift to a new identity, brick-and-mortar can attract a younger demographic. Shopify found that those under 34 who usually purchase online will first review the item in brick-and-mortar.

Retailers who can engage them in that physical setting could land the sale and the longer-term relationship. One tactic could be to bring up on a smartphone the online item, then pitch the advantages of making that purchase right there and then in the store. For some retailers this will represent leaning into the realities of ecommerce versus struggling to ignore them.

That moment of truth

In sales of all types, there is that moment of truth. That is when customers make the internal decision to buy or not to buy. To be polite, they may pretend to continue to be involved with the rest of the process. But there will be no sale. In hybrid retail, that moment of truth will increasingly occur – and it could be positive – when shoppers recognize brick-and-mortar is in the loop with online everything.